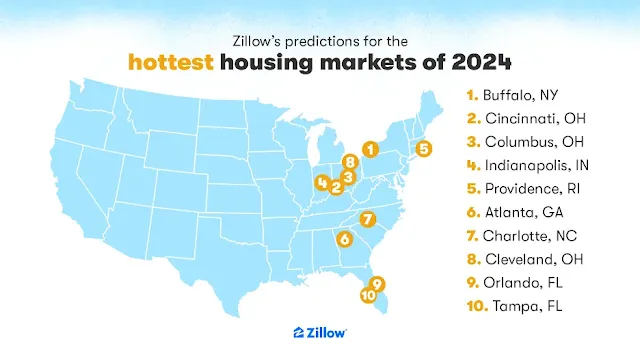

Zillow's annual predictions for the

hottest housing markets in 2024 include Buffalo, N.Y., as the top market,

followed by Cincinnati, Columbus (Ohio), Indianapolis, and Providence, R.I. The

rankings are based on factors such as expected home value growth, projected

change in owner-occupied households, job growth compared to new construction, and

other economic fundamentals.

The Midwest, Great Lakes, and South regions dominate the list, with Charlotte, last year's hottest market, still near the top. Despite recent improvements in mortgage rates, challenges like low inventory and relatively high prices are expected to persist in the housing market in 2024.

Zillow's list of the hottest

housing markets in 2024 is determined by factors such as forecast home value

growth, recent housing market activity, and projected changes in the labor

market, home construction, and homeowner households. Buffalo, N.Y., is at the

top of the list due to recent job creation outpacing new home construction

projects and expectations of stable home values.

Cincinnati ranks second, mainly because of its high market velocity, with homes typically going pending in a median of just five or six days for most months in 2023. The analysis considers these factors to identify markets with strong economic fundamentals and potential for stable home values.

Price Growth

In 2023, home value growth slowed

down, influenced largely by the highest mortgage interest rates since 2008. For

2024, only 15 out of the 50 largest markets are expected to experience home

value growth. Even the fastest-growing markets in 2023 are anticipated to see

significant slowdowns.

Hartford had the highest year-over-year home value growth among large markets in 2023 at 11%, but it is expected to decline to 0.7% in 2024. Charlotte, last year's hottest market, is expected to maintain steady growth at 1.2%, while Buffalo's typical home value is projected to decline by 0.2% in 2024.

Inventory & Velocity

In 2023, the inflow of new listings

slowed significantly compared to the previous year, leading to multi-year lows

in for-sale inventory. Low-inventory markets, where buyers faced challenges in

finding homes and properties sold quickly in 2023, are expected to continue

experiencing high demand relative to supply in 2024.

The markets with the fewest listing days per home in 2023, indicating fast-selling homes, were Hartford, Cincinnati, and Columbus.

Demographics

In 2024, only 14 of the 50 largest

markets are expected to see an increase in homeownership. Columbus leads in the

for-sale market lift, with a trend suggesting a formation of 11.4% more owning

households (assuming homes are available). Austin and Memphis follow at 9.7%

and 9.6%, respectively. Markets with negative demographic pressure, where

homeownership is expected to decrease, include Birmingham (-25%), San Diego

(-21.8%), and Oklahoma City (-20.2%).

The coolest metro areas of 2024, characterized by expected annual home value declines and a projected decline in owner-occupied households, include New Orleans, San Antonio, Denver, Houston, and Minneapolis. New Orleans is expected to have the most significant decline, with a 6% fall in typical home values in 2024.

Methodology

The final index relied on the

following information:

- Anticipated yearly appreciation in home values

for November 2024

- Predicted acceleration in home value appreciation

from November 2023 to November 2024

- Duration of home listings from January 2023 to

November 2023

- Change in total non-farm employment over two

years per two-year residential building permit total

- Estimated alteration in owner-occupied households

from 2023 to 2024

Metrics were standardized based on available metro-level data, using standard deviations from the mean. Mean and standard deviation were weighted according to housing unit counts and capped at ±1.96 to avoid penalizing metros for extreme data points. The final index represents an average across metrics, with standardized home price appreciation (HPA) acceleration down-weighted by half.

Listing days per home, representing

inventory and velocity, utilized Zillow data for Median Days to Pending and New

Listings.

For job market and building data,

the ratio of employment change to the total permitted residential structures

was calculated. Total non-farm employment (seasonally adjusted) came from the

U.S. Bureau of Labor Statistics Current Employment Statistics survey, using the

3-year change from November 2020 to November 2023. Building permit data was

sourced from New Private Housing Structures Authorized by Building Permits,

summing over the 2-year period from November 2020 to November 2023.

To evaluate demographic pressure in the for-sale housing market, projected changes in homeowner households from 2023 to 2024 were considered. This projection factored in population aging and migration patterns, using data from the American Community Survey (ACS) from 2021 (5-year sample) and 2022 (1-year sample) obtained from IPUMS USA, University of Minnesota.

The assessment involved a two-stage process. The first stage utilized a larger 5-year sample to calculate entry and exit from the population by age (due to birth, migration, death). The second stage applied age-specific rates of population change to the 1-year sample, iterating over 2023-2024 for ages 18-89.

Keeping the observed age-specific

share of the population who is the head of household of an owner-occupied

housing unit constant, the percentage change in the number of owner-heads

expected in 2024 compared to 2023, by age, was estimated. Summing these changes

provided a demographically expected rate of increase in homeowner households in

2024.

All population and owner-headship

counts were smoothed across ages over a 5-year centered window before

calculating rates and changes.

0 Comments